ASX Announcement 27 April 2022

1 University Avenue

Macquarie University

NSW 2109 AUSTRALIA

www.cochlear.com

Cochlear Limited, a global leader in implantable hearing solutions, agrees to acquire Oticon Medical for DKK 850million (approx.AUD170million) following Demant’s decision to exit its hearing implants business activities. As part of the transaction, Cochlear has committed to providing ongoing support for Oticon Medical’s base of more than 75,000 hearing implant recipients, which includes cochlear and acoustic implants.

Cochlear’s CEO & President, Dig Howitt said, “We look forward to welcoming Oticon Medical’s implant customers to the Cochlear family. Driven by our mission to innovate and deliver a lifetime of hearing outcomes, we will seek to ensure that Oticon Medical’s customers continue to be supported with a life time of hearing solutions. We will work closely with Demant to ensurea seamless transition, with continued access to current Oticon Medical technology for customers in the coming years. We will develop next generation sound processors and services that will enable customers to transition to and benefit from Cochlear’s technology platform overtime.

The acquisition of Oticon Medical will provide us with greater scale and will enable us to increase our investments in R&D and market growth activities. While Cochlear is a market leader in implantable hearing, we are a small player in the hearing loss segment where hearing aids remain the primary treatment option. Our goal is to improve the penetration of implantable hearing solutions, building customer awareness and confidence, and offering more patient shearing solutions best suited to their individual needs.

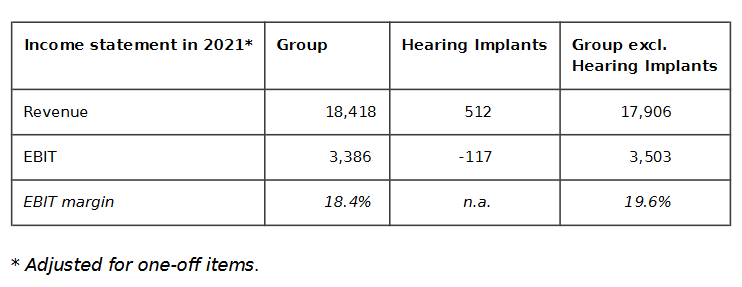

“Oticon Medical is expected to add AUD 75‐80 million to annual revenue. The business is currently loss making. Our priority post‐closing of the transaction will be to determine and implement a plan that returns the business to profitability as quickly as possible. Integration costs, which include the development of compatible next generation sound processors, are yet to be determined and could range from $30 ‐ 60 million. We continue to target along‐term net profit margin of 18%.”

To comply with French labour law requirements, the proposed transaction will be subject to a mandatory consultation process with Oticon Medical’s Nice‐based employee works council. Completion of the transaction will be conditional on satisfaction of customary closing conditions and receipt of competition approvals injurisdictions where the transaction meets relevant notification thresholds. The acquisition will be funded from existing cash balances and is expected to close in the second half of 2022. Cochlear will not be assuming any liability for issues that may arise from the voluntary field corrective action for Oticon Medical’s Neuro Zti cochlear implant announced in October 2021.